CT CT-IFTA-2 2022-2025 free printable template

Show details

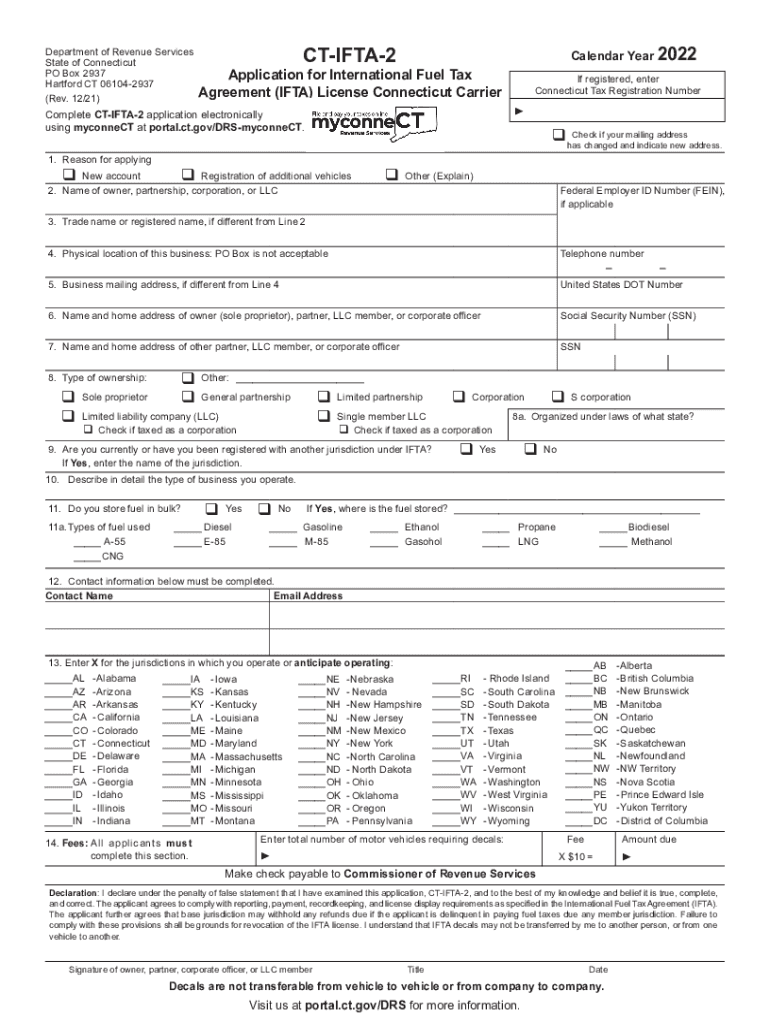

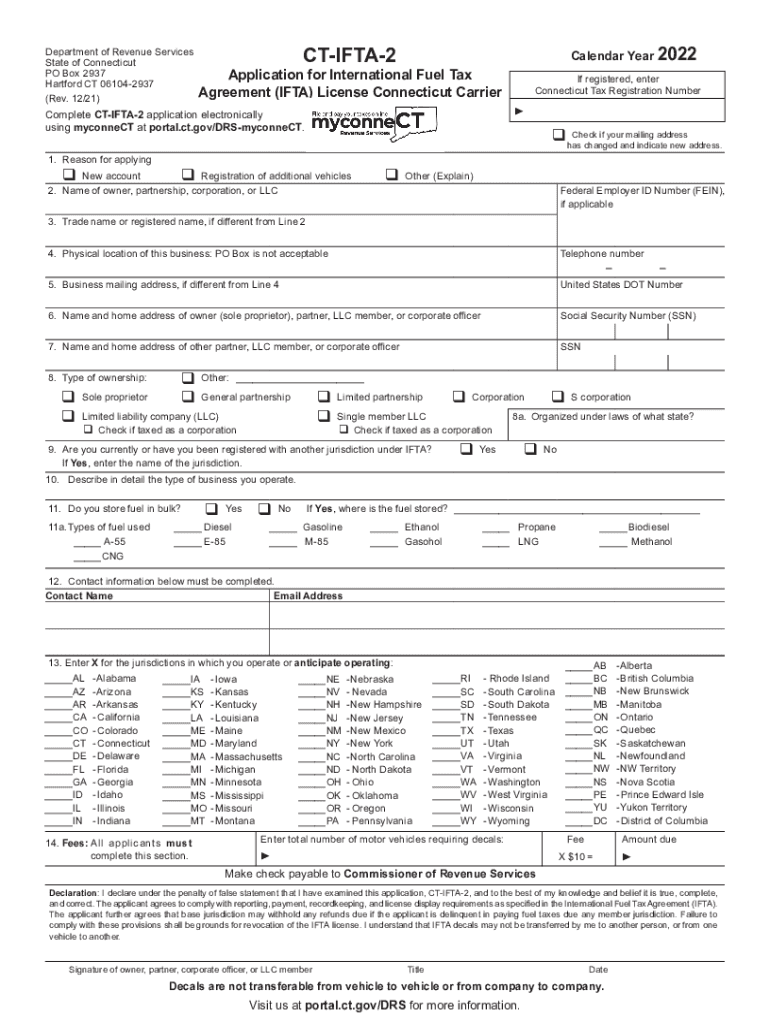

Department of Revenue Services State of Connecticut PO Box 2937 Hartford CT 061042937 (Rev. 12/21)CTIFTA2Application for International Fuel Tax Agreement (IFTA) License Connecticut Carrier registered,

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign CT CT-IFTA-2

Edit your CT CT-IFTA-2 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your CT CT-IFTA-2 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit CT CT-IFTA-2 online

Follow the steps down below to take advantage of the professional PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit CT CT-IFTA-2. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

CT CT-IFTA-2 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out CT CT-IFTA-2

How to fill out CT CT-IFTA-2

01

Download the CT CT-IFTA-2 form from the Connecticut Department of Revenue Services website.

02

Enter your business information, including name, address, and federal employer identification number (FEIN).

03

Report the taxable mileage traveled in Connecticut and other states during the reporting period.

04

Calculate the total fuel gallons purchased in Connecticut and other states.

05

Report any credits for tax paid on fuel purchased in Connecticut.

06

Compute the total tax due based on the mileage and fuel information provided.

07

Sign and date the form before submitting it.

08

Submit the completed form by the due date along with any payment due.

Who needs CT CT-IFTA-2?

01

Motor carriers operating in Connecticut who have traveled in multiple jurisdictions.

02

Businesses that must report fuel use tax and mileage traveled in connection with their operations.

03

Individuals and companies that fall under the International Fuel Tax Agreement (IFTA) rules.

Fill

form

: Try Risk Free

People Also Ask about

How do I renew my Florida IFTA sticker?

0:18 2:26 Processing Your IFTA Renewal Online - YouTube YouTube Start of suggested clip End of suggested clip And three dollars for the new tip to license. Select continue when you have entered the number ofMoreAnd three dollars for the new tip to license. Select continue when you have entered the number of decals needed selecting cancel will return you to the IFTA menu.

How much is a Florida IFTA sticker?

IFTA Fees. There is no fee for the annual IFTA license. IFTA decals are $4.00 per set (pair).

Do local trucks need IFTA?

Yes, federal law requires that commercial truck companies abide by IFTA regulations.

How much is a fuel tax sticker in Florida?

There is a $4 fee for each set of decals. You will need one set per qualified vehicle. Once the application is approved, credentials will be mailed within 24 hours and you should receive them within 7-14 business days. Same day decals are available when you physically take the application into the office.

How do I get my IFTA stickers in CT?

To register for the first time as an International Fuel Tax Agreement (IFTA) licensee in Connecticut, you must register with the Department of Revenue Services (DRS) as a Connecticut business and complete the IFTA/Motor Carrier registration through myconneCT.

What is the phone number for the IFTA in CT?

If you have any questions about the application, you may contact the DRS, Registration Unit between 8:00 a.m. and 5:00 p.m., weekdays, at 860-297-4870.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Who is required to file ct-ifta-2 application for international?

The CT-IFTA-2 application for International Fuel Tax Agreement (IFTA) is typically filed by motor carriers who operate qualified motor vehicles across jurisdictional boundaries within the IFTA member jurisdictions. Motor carriers that transport passengers or property for hire, have a gross vehicle weight rating (GVWR) or registered gross vehicle weight (RGVW) of over 26,000 pounds, or have three or more axles, are generally required to file the CT-IFTA-2 application for IFTA.

How to fill out ct-ifta-2 application for international?

To fill out the CT-IFTA-2 application for international, follow these steps:

1. Obtain the CT-IFTA-2 form: You can either download it from the Connecticut Department of Revenue Services (DRS) website or request a copy from the DRS directly.

2. Provide the necessary information: Fill in the required information on the form, which includes:

- The name of the registered owner or lessee of the motor vehicles

- The mailing address of the registered owner or lessee

- The International Fuel Tax Agreement account number

- The International Registration Plan account number

3. Enter vehicle details: Include the details for each vehicle under the account, such as:

- Vehicle identification number (VIN)

- License plate number

- Make and model of the vehicle

4. Report fuel consumption: Provide information regarding the fuel consumption for each vehicle during the reporting period, including:

- Beginning and ending dates of the reporting period

- Total miles/kilometers traveled in each jurisdiction

- The number of taxable and nontaxable miles/kilometers traveled in each jurisdiction

- Total taxable gallons/liters of fuel purchased in each jurisdiction

5. Complete the worksheet: Use the worksheet provided on the form to calculate the total miles traveled and fuel consumed, as well as the tax due for each jurisdiction.

6. Sign and date the form: Ensure that the registered owner or lessee signs and dates the form.

7. Submit the application: Submit the completed CT-IFTA-2 form to the Connecticut DRS along with any required attachments and payment of the calculated tax due.

Note: It is advisable to consult the official instructions provided by the Connecticut DRS or seek professional assistance to ensure accurate completion of the CT-IFTA-2 form for international applications.

What information must be reported on ct-ifta-2 application for international?

The CT-IFTA-2 application for international must include the following information:

1. Name and contact information of the applicant, including address, phone number, and email address.

2. Vehicle information, such as the make, model, year, vehicle identification number (VIN), and license plate number.

3. Power unit information, including the power unit's manufacturer, model, and serial number.

4. International Fuel Tax Agreement (IFTA) license number, if applicable.

5. Validity period of the IFTA license.

6. Base jurisdiction information, including the state or province where the IFTA license is issued.

7. The number of fuel decals required for each vehicle and the jurisdiction for which the decals are being requested.

8. Explanation of vehicle types, such as whether it is a power unit, trailer, or qualified motor vehicle.

9. Fuel type used by the vehicle, such as diesel, gasoline, propane, natural gas, or others.

10. Distance records, including total distance traveled in each jurisdiction during the reporting period.

11. Fuel records, including the total number of gallons or liters purchased, the fuel receipts, and the date of each purchase.

12. Calculation of fuel tax due, including the taxable gallons or liters, the tax rate, and the total tax due for each jurisdiction.

13. Declaration statement, where the applicant confirms that the information provided is true and accurate.

14. Signature and date.

It is recommended to consult the specific guidelines provided by the Connecticut Department of Revenue Services or consult a qualified tax professional for accurate and up-to-date information regarding filing the CT-IFTA-2 application for international.

How can I edit CT CT-IFTA-2 from Google Drive?

Using pdfFiller with Google Docs allows you to create, amend, and sign documents straight from your Google Drive. The add-on turns your CT CT-IFTA-2 into a dynamic fillable form that you can manage and eSign from anywhere.

Can I sign the CT CT-IFTA-2 electronically in Chrome?

Yes. By adding the solution to your Chrome browser, you may use pdfFiller to eSign documents while also enjoying all of the PDF editor's capabilities in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a photo of your handwritten signature using the extension. Whatever option you select, you'll be able to eSign your CT CT-IFTA-2 in seconds.

How do I edit CT CT-IFTA-2 straight from my smartphone?

You can do so easily with pdfFiller’s applications for iOS and Android devices, which can be found at the Apple Store and Google Play Store, respectively. Alternatively, you can get the app on our web page: https://edit-pdf-ios-android.pdffiller.com/. Install the application, log in, and start editing CT CT-IFTA-2 right away.

What is CT CT-IFTA-2?

CT CT-IFTA-2 is a tax form used to report and pay fuel taxes for fleet operators who operate in multiple jurisdictions under the International Fuel Tax Agreement (IFTA).

Who is required to file CT CT-IFTA-2?

Motor carriers who hold an IFTA license and operate qualified motor vehicles in Connecticut or other IFTA member jurisdictions are required to file the CT CT-IFTA-2.

How to fill out CT CT-IFTA-2?

To fill out the CT CT-IFTA-2, gather your fuel purchase and mileage records for each jurisdiction, complete the form by entering the required information in the designated fields, calculate the taxes due, and submit it to the appropriate tax authority.

What is the purpose of CT CT-IFTA-2?

The purpose of CT CT-IFTA-2 is to allow fleet operators to report their fuel usage and pay the appropriate fuel taxes to the correct jurisdictions in a simplified manner under the IFTA framework.

What information must be reported on CT CT-IFTA-2?

The information that must be reported on CT CT-IFTA-2 includes the total miles traveled in each jurisdiction, gallons of fuel purchased in each jurisdiction, and any tax liability or credits for refunds related to fuel usage.

Fill out your CT CT-IFTA-2 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

CT CT-IFTA-2 is not the form you're looking for?Search for another form here.

Relevant keywords

If you believe that this page should be taken down, please follow our DMCA take down process

here

.